BTC Price Prediction: Analyzing the Path to $120K Amid Market Turbulence

#BTC

- Technical Bottoming: Oversold RSI + MACD divergence suggests reversal potential

- Institutional Demand: Public companies adding BTC worth $1.15B+ this month

- Sentiment Extreme Fear index readings historically precede 50%+ rallies

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Rebound

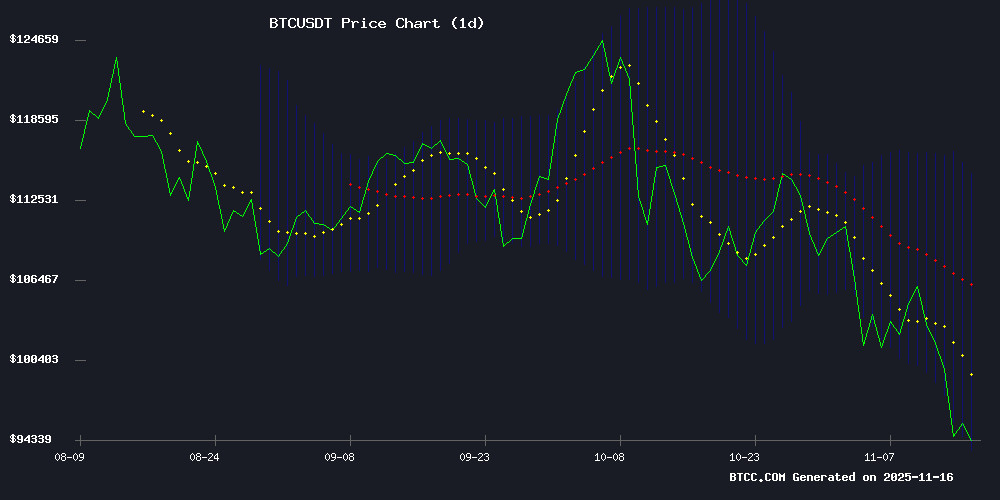

BTC is currently trading at $95,788, below its 20-day moving average of $104,078. The MACD shows bullish momentum with the histogram at 1,880, suggesting growing buyer interest. Bollinger Bands indicate volatility compression, with price hovering NEAR the lower band at $93,834 - a potential reversal zone. 'This consolidation near support could fuel the next leg up,' says BTCC's Robert.

Market Sentiment: Extreme Fear Meets Institutional Accumulation

Despite Bitcoin's drop below $100K triggering panic, institutional players like MicroStrategy are aggressively accumulating. The Fear & Greed Index hit extreme lows while analysts highlight $96K as critical support. 'This is classic whale behavior - buying when retail capitulates,' notes Robert. ETF flows and mining developments remain key watchpoints.

Factors Influencing BTC's Price

Bitcoin Fear Index Hits Extreme Low Amid Market Correction, Analysts Remain Bullish

Bitcoin's Fear & Greed Index plummeted to 10—indicating extreme fear—as prices corrected 25% from recent highs. Yet seasoned analysts argue this dip aligns with historical bull market behavior rather than signaling its end.

Ran Neuner, CNBC crypto commentator and Crypto Banter founder, draws parallels to past cycles. "Bull markets don't die quietly," he observes, citing the dot-com bust and 2021 crypto peak as examples where systemic failures or collapsed faith were required to end rallies. The current pullback mirrors mid-cycle corrections seen in 2017 and 2021.

Technical analysts anticipate a rebound toward $101K-$103K, followed by potential retracement to $92K. The market's violent swings reflect typical crypto volatility rather than fundamental breakdown, with on-chain data suggesting accumulation by long-term holders continues unabated.

Bitcoin Plunges Below $100,000 Triggering Market-Wide Fear

Bitcoin's drop below the $100,000 threshold has sent shockwaves through the cryptocurrency market, pushing the Fear and Greed Index to an alarming 10—deep into 'extreme fear' territory. The sell-off marks the second such decline this month, with BTC shedding over 7% in a week to hover near $96,000.

Altcoins face even steeper carnage. Glassnode data reveals just 5% of altcoin holdings remain profitable—a capitulation event rivaling the worst drawdowns in recent years. Thin exchange liquidity, institutional withdrawals, and eroding macro confidence compound the pressure.

The market's fragility is laid bare by this bifurcation: while Bitcoin stumbles, altcoins hemorrhage value. Traders now watch macroeconomic signals with renewed urgency as rate cut uncertainties amplify existing weaknesses.

Bitcoin Holds $96K Support as Bulls Eye Break Above $103K for Momentum

Bitcoin's price stability near $96,000 signals cautious optimism among traders, with a decisive break above $103,000 needed to confirm bullish momentum. Trading volume remains robust, and BTC's market capitalization holds firm above $1.8 trillion, reinforcing analyst expectations of a rebound toward the $101,000–$103,000 range.

The CME futures gap at $92,000 continues to dominate trader discussions, with historical patterns suggesting Bitcoin may retest this level before any sustained upward movement. "BTC is now getting closer to its $92K CME gap," noted analyst Ted (@TedPillows). "At this point, Bitcoin is likely to fill this gap before any bounceback."

Market sentiment remains divided. While some interpret the current pullback as the start of a deeper correction, others view it as a routine retracement within Bitcoin's broader uptrend. Resistance between $99,000 and $111,000 has proven formidable, but high-timeframe demand and improving liquidity conditions suggest underlying strength.

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Bitcoin's sharp decline below $94,000 triggered market-wide anxiety, with speculation swirling around potential sell-offs by major holders. Michael Saylor swiftly countered rumors that his firm, Strategy, was liquidating Bitcoin positions, confirming instead that the company had expanded its holdings during the downturn.

Blockchain analytics platform Arkham clarified that observed BTC transfers represented routine custodian adjustments rather than disposals. Strategy's treasury now safeguards 641,692 BTC—worth approximately $62 billion—following a strategic acquisition of 487 BTC financed through preferred shares.

Market analysts highlight Strategy's robust financial position, with liquidation thresholds remaining safely below current price levels. The episode underscores how institutional players increasingly view volatility as accumulation opportunities rather than exit signals.

DAT Structures Lead to $17B Loss for Retail Investors Amid Crypto Downturn

Retail investors are reeling from $17 billion in losses tied to Digital Asset Treasury (DAT) structures as cryptocurrency markets face heightened volatility. Bitcoin's plunge below $100,000 has eroded confidence in these once-premium investment vehicles, with many now trading at a discount to net asset value.

In-kind contributions and unlisted tokens have exacerbated market turbulence, amplifying risks for individual investors. The Bloomberg analysis reveals a stark reversal for DATs—formerly perceived as a safety net—now functioning as a liability in the current downturn.

"DAT structures can resemble circular trades," warned HM's Chris Holland, highlighting the disproportionate burden on retail participants. The sector's rapid decline underscores the fragility of crypto-linked investment products during market contractions.

Bitcoin’s Drop Won’t Last If Capital Keeps Flowing, Says CryptoQuant CEO

Bitcoin’s price structure remains resilient despite recent declines, according to CryptoQuant CEO Ki Young Ju. The cryptocurrency’s realized cap hitting a record $1.12 trillion signals sustained market demand, even as prices dipped below $100,000. Institutional investments, including Strive’s $162 million purchase, underscore growing confidence.

Ju attributes the recent slide to a strengthening US dollar and rising real yields, dismissing it as a temporary setback rather than a long-term weakness. "Capital is still flowing into Bitcoin," he noted, suggesting a rebound could occur if macroeconomic sentiment shifts and long-term holders reduce selling pressure.

Crypto Fraud Sentences: Wolf Capital CEO Gets 5 Years, “Cryptoqueen” Jailed 11+ Years

Travis Ford, CEO of Wolf Capital Crypto Trading, has been sentenced to five years in prison for orchestrating a $9.4 million Ponzi scheme that defrauded 2,800 investors. The U.S. Department of Justice ordered Ford to forfeit over $1 million and pay $170,000 in restitution. Ford lured victims with promises of unrealistic daily returns of 1–2%, which he admitted were impossible to sustain.

In a separate case, Chinese Ponzi operator Zhimin Qian received over 11 years in prison after defrauding 128,000 individuals, with authorities seizing 61,000 Bitcoin. These high-profile cases underscore the escalating global crackdown on crypto-related fraud, as regulators intensify scrutiny of digital asset schemes.

Bitcoin's ETF-Era Channels Tested as Price Slips Below Key Levels

Bitcoin's rally to $79,000 this year now faces a stern test as prices breach critical support levels. The cryptocurrency has fallen below $106,400 and $99,000 in quick succession, erasing the optimism that recently fueled predictions of six-figure valuations.

The breakdown follows a pattern established since January's ETF launch, where horizontal price channels have served as reliable liquidity indicators. These bands—visible on TradingView charts—represent consolidation zones where market participants accumulated positions. Their violation signals a decisive shift in sentiment.

This cycle defies historical norms. Bitcoin achieved new all-time highs months before April's halving, diverging from previous cycles where peaks followed the supply shock. The early breakout now meets equally premature selling pressure, leaving traders to question whether institutional inflows via ETFs can sustain momentum.

CleanSpark Secures $1.15B Zero-Coupon Convertible Notes to Navigate Bitcoin Mining Turmoil

CleanSpark has raised $1.15 billion through zero-coupon convertible notes, a bold move to bolster its position in the fiercely competitive Bitcoin mining sector. The private placement, due in 2032, carries an initial conversion price of $19.16—a 27.5% premium to its current stock price. Nearly $460 million will be used for share buybacks, while the remainder fuels expansion into power infrastructure, data centers, and AI capabilities.

The deal underscores the harsh realities of Bitcoin mining economics in 2025. With the network's hashrate surpassing one zettahash per second, miners face existential pressure to scale or perish. CleanSpark's balance sheet now bears $1.7 billion in long-term debt against a treasury of 12,100 BTC, making cash flow sustainability paramount.

Investors' acceptance of zero-coupon terms signals strong conviction in CleanSpark's equity upside. The market appears to be betting that the miner can outlast cyclical downturns and infrastructure bottlenecks—a testament to institutional confidence in Bitcoin's long-term value proposition.

MicroStrategy's Bitcoin Accumulation Strategy Defies Market Timing Conventions

MicroStrategy, under Michael Saylor's leadership, continues its unorthodox Bitcoin acquisition strategy—consistently purchasing at local price tops. The firm's latest SEC filing reveals a $49.9 million buy of 487 BTC at an average of $102,557 per coin between November 3-9, coinciding with a weekly high above $106,000 before a 9% pullback.

This pattern mirrors previous purchases near short-term peaks, raising questions about execution timing. CryptoQuant data visualizes the firm's tendency to buy during strength periods rather than dips. While appearing counterintuitive, this approach reflects a long-term accumulation thesis indifferent to volatility.

Bitcoin's current price action shows consolidation between $100,000 support and $106,400 resistance. MicroStrategy's $17 billion BTC holdings now represent a strategic bet on institutional adoption trumping short-term price fluctuations.

Bitcoin Sell-Off Blamed on New Investors as Analysts Predict Recovery

Samson Mow, CEO of JAN3, attributes Bitcoin's recent downturn to inexperienced investors entering the market within the past 18 months. These newcomers allegedly sold positions after modest 20-30% gains, creating cascading panic. On-chain data reveals long-term holders are also taking profits, exacerbating market jitters.

Despite short-term volatility, analysts forecast a 24.83% rebound. Mow maintains bullish conviction, positioning 2026 as a watershed year for crypto markets. His optimism echoes Cardano founder Charles Hoskinson's outlook, suggesting institutional players anticipate a major cycle ahead.

How High Will BTC Price Go?

Based on technicals and market structure, BTC could rally towards $120K if key resistance breaks:

| Level | Significance |

|---|---|

| $96,000 | Strong support (held 3x) |

| $103,000 | 20MA & psychological resistance |

| $114,322 | Bollinger upper band |

| $120,000 | Fibonacci extension |

Robert observes: 'The MACD crossover and institutional accumulation pattern mirror Q4 2024's rally setup. Maintaining $96K opens path to test $103K within weeks.'